Malaysia Private Health Insurance Sees Strong Growth Driven by Rising Healthcare Costs

Executive Summary Malaysia Private Health Insurance Market Size and Share Forecast

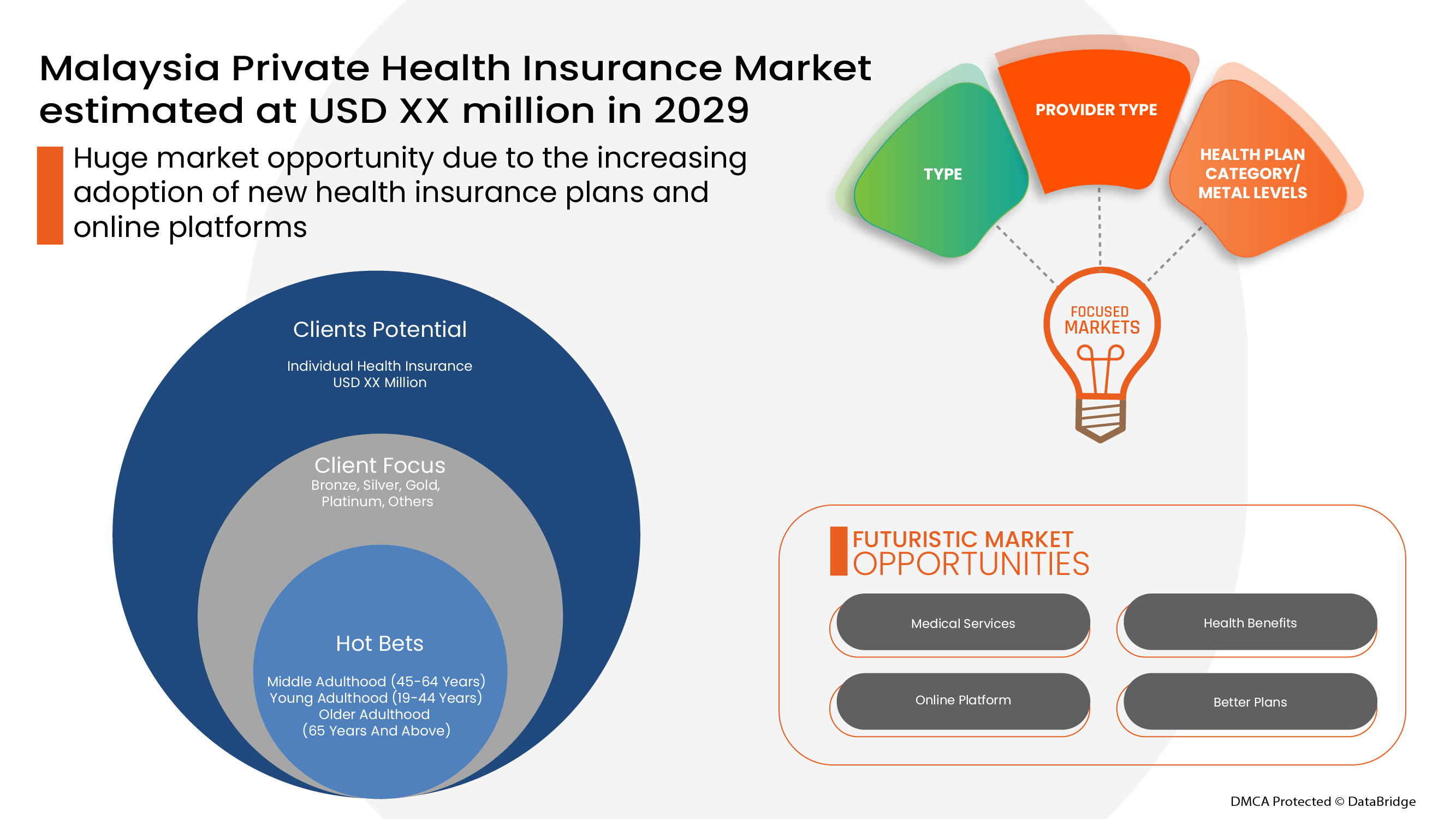

Data Bridge Market Research analyses that the private health insurance market is expected to reach the value of USD 2,353.93 million by the year 2029, at a CAGR of 1.6% during the forecast period.

Malaysia Private Health Insurance Market research report brings into focus the key market dynamics of the sector. The Malaysia Private Health Insurance Market study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities, challenges, risks, entry barriers, sales channels, distributors, and Porter's Five Forces Analysis. The Malaysia Private Health Insurance report makes available fluctuations in CAGR values during the forecast period for the market. This transformation in the market landscape is mainly observed due to the moves of key players or brands, which include developments, product launches, joint ventures, mergers, and acquisitions that in turn change the view of the global face of the industry.

Market definition, market segmentation, key developments in the market, competitive analysis, and research methodology are the major topics in which this Malaysia Private Health Insurance report is divided. This market report covers an array of factors that have an influence on the market and the keyword market industry, which includes industry insight and critical success factors (CSFs), market segmentation and value chain analysis, industry dynamics, drivers, restraints, key opportunities, technology and application outlook, country-level and regional analysis, competitive landscape, company market share analysis, and key company profiles. For sound decision-making and superior management of goods and services, these days businesses are adopting a market research report solution.

Gain clarity on industry shifts, growth areas, and forecasts in our Malaysia Private Health Insurance Market report. Get your copy:

https://www.databridgemarketresearch.com/reports/malaysia-private-health-insurance-market

Malaysia Private Health Insurance Market Review

Segments

- On the basis of type, the Malaysia private health insurance market can be segmented into lifetime coverage, term insurance, and fixed reimbursement coverage.

- Geographically, the market can be segmented into urban and rural areas, with different preferences and needs in each segment.

- Demographically, the market can be divided based on age groups, with specific products and services tailored for different age brackets.

- Employer-provided health insurance is also a significant segment, where companies offer private health insurance as part of employee benefits packages.

Market Players

- AIA Group Limited: A leading provider of private health insurance in Malaysia, offering a wide range of health insurance products.

- Prudential Corporation Asia: Another major player in the Malaysia private health insurance market, known for its innovative health insurance solutions.

- Allianz Malaysia Berhad: With a strong presence in the country, Allianz offers various private health insurance options for individuals and families.

- Great Eastern Takaful Berhad: Specializing in takaful health insurance products, Great Eastern is a key player in the market.

- Sun Life Malaysia: Sun Life offers comprehensive private health insurance coverage and has a growing customer base in Malaysia.

The Malaysia private health insurance market is witnessing growth and evolving due to various factors, including increasing awareness about the importance of health insurance, rising healthcare costs, and shifting consumer preferences towards better healthcare services. The segmentation of the market allows insurers to target specific customer groups effectively, offering tailored products and services to meet their varying needs.

Market players in Malaysia are constantly innovating to differentiate their offerings and stay competitive in the market. Companies like AIA Group Limited and Prudential Corporation Asia are leveraging technology to enhance customer experience and streamline insurance processes. Additionally, partnerships with healthcare providers and digital solutions are becoming increasingly common to improve access to healthcare services for policyholders.

Overall, the Malaysia private health insurance market presents opportunities for growth and expansion for both existing and new players. Understanding the diverse needs of customers across different segments and providing innovative solutions will be crucial for success in this dynamic market.

The Malaysia private health insurance market is undoubtedly a dynamic and evolving sector, driven by a multitude of factors that are reshaping the industry landscape. One key aspect that could provide new insights into this market is the impact of regulatory changes and government policies on the private health insurance sector in Malaysia. Government interventions, such as new regulations or initiatives to promote healthcare coverage, can significantly influence market dynamics and create both challenges and opportunities for insurers operating in the country.

The evolving regulatory environment in Malaysia, aimed at enhancing the overall healthcare system and improving access to quality healthcare services, plays a pivotal role in shaping the private health insurance market. For instance, regulatory reforms focused on consumer protection, affordability, and transparency can impact the way insurers design their products and interact with customers. Understanding and adapting to these regulatory requirements are crucial for market players to ensure compliance and maintain a competitive edge.

Moreover, government initiatives to promote universal health coverage or expand healthcare access to underserved populations can drive demand for private health insurance products. Insurers that align their offerings with the national healthcare agenda and cater to the evolving needs of the population stand to benefit from these macro-level trends. Partnering with government entities or participating in public-private collaborations could also open up new avenues for growth and market penetration.

Another emerging trend in the Malaysia private health insurance market is the increasing focus on preventive healthcare and wellness programs. Insurers are recognizing the value of promoting healthy lifestyles and early intervention to reduce healthcare costs and improve overall health outcomes. By incorporating wellness initiatives into their product offerings and incentivizing policyholders to adopt healthy behaviors, insurers can position themselves as partners in their customers' health journeys.

Furthermore, the growing adoption of digital technologies in the healthcare industry presents opportunities for insurers to enhance customer engagement, streamline operations, and drive innovation in service delivery. Embracing telehealth services, mobile apps for policy management, and data analytics for personalized care could differentiate market players and attract tech-savvy consumers seeking convenience and efficiency in their healthcare experience.

In summary, by closely monitoring and adapting to regulatory changes, aligning with government healthcare initiatives, emphasizing preventive healthcare, and leveraging digital innovation, insurers in the Malaysia private health insurance market can navigate complexities and capitalize on emerging opportunities for sustainable growth and market leadership.The Malaysia private health insurance market is a dynamic and rapidly evolving sector that is influenced by various factors reshaping the industry landscape. One significant aspect that can provide new insights into this market is the impact of regulatory changes and government policies on the private health insurance sector in Malaysia. Government interventions, such as new regulations or initiatives to promote healthcare coverage, can significantly influence market dynamics and create both challenges and opportunities for insurers operating in the country.

The evolving regulatory environment in Malaysia, aimed at enhancing the overall healthcare system and improving access to quality healthcare services, plays a pivotal role in shaping the private health insurance market. Regulatory reforms focused on consumer protection, affordability, and transparency can impact how insurers design their products and engage with customers. Adapting to these regulatory requirements is crucial for market players to ensure compliance and maintain competitiveness.

Furthermore, government initiatives to promote universal health coverage or expand healthcare access to underserved populations can drive demand for private health insurance products. Insurers that align their offerings with the national healthcare agenda and cater to the evolving needs of the population stand to benefit from these macro-level trends. Collaborating with government entities or engaging in public-private partnerships could create new growth opportunities for insurers in the market.

Another emerging trend in the Malaysia private health insurance market is the growing focus on preventive healthcare and wellness programs. Insurers are increasingly recognizing the value of promoting healthy lifestyles and early intervention to mitigate healthcare costs and improve overall health outcomes. By integrating wellness initiatives into their product offerings and incentivizing policyholders to adopt healthy behaviors, insurers can position themselves as partners in their customers' health journeys.

Moreover, with the rising adoption of digital technologies in the healthcare industry, insurers have the opportunity to enhance customer engagement, streamline operations, and drive innovation in service delivery. Implementing telehealth services, developing mobile apps for policy management, and leveraging data analytics for personalized care can differentiate market players and attract tech-savvy consumers seeking convenience and efficiency in their healthcare experience.

In conclusion, by closely monitoring and adapting to regulatory changes, aligning with government healthcare initiatives, emphasizing preventive healthcare, and embracing digital innovation, insurers in the Malaysia private health insurance market can navigate complexities and capitalize on emerging opportunities for sustainable growth and market leadership.

Uncover the company’s portion of market ownership

https://www.databridgemarketresearch.com/reports/malaysia-private-health-insurance-market/companies

Structured Market Research Questions for Malaysia Private Health Insurance Market

- What is the present size of the global Malaysia Private Health Insurance industry?

- What annual growth rate is projected for the Malaysia Private Health Insurance sector?

- What are the main segment divisions in the Malaysia Private Health Insurance Market report?

- Who are the established players in the global Malaysia Private Health Insurance Market?

- What geographic areas are explored in the Malaysia Private Health Insurance Market report?

- Who are the leading manufacturers and service providers for Malaysia Private Health Insurance Market?

Browse More Reports:

Global Patient Derived Xenograft (PDX) Models Market

Global Pharmacological Chaperone Drug Market

Global Plastic Optical Fiber Market

Global Plastic Solenoid Valves Market

Global Point-to-Point (P2P) Antennas Market

Global Polypropylene Foams Market

Global Posaconazole Market

Global Powder Induction and Dispersion Systems Market

Global Power Quality Equipment Market

Global Primary Water and Wastewater Treatment Equipment Market

Global Process Analytics Market

Global Prosthetic Heart Valve Market

Global Proteasome Inhibitors Market

Global Public Announcement System Market

Global Rapid-Acting Insulin Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Malaysia_health_insurance

- private_medical_insurance

- hospitalization_coverage

- medical_riders

- critical_illness_plans

- cashless_hospitalization

- healthcare_inflation

- insurance_premiums

- outpatient_coverage

- family_health_plans

- takaful_Malaysia

- medical_card_Malaysia

- health_policy_benefits

- insurance_claim_process

- digital_insurance_Malaysia

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness