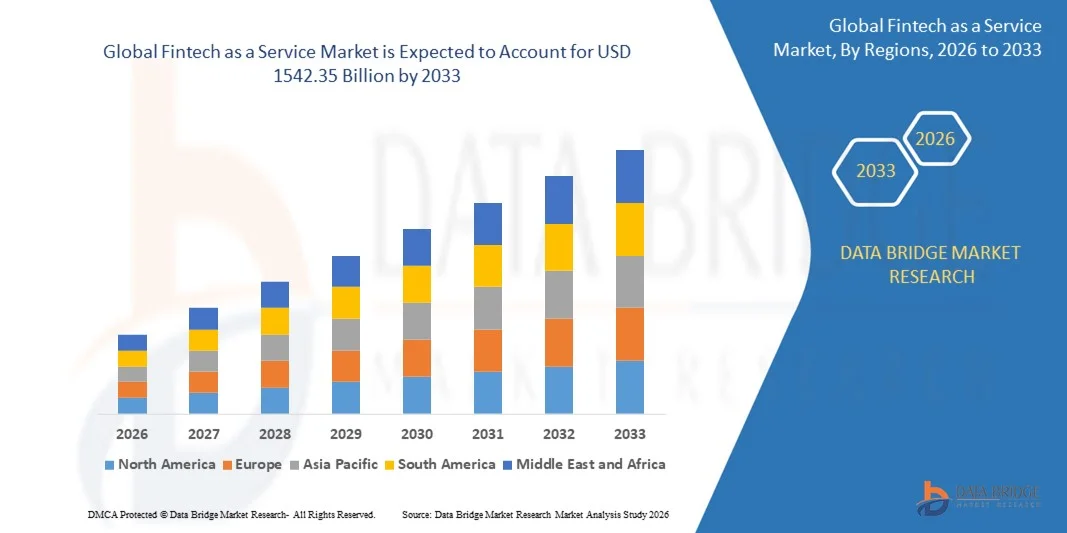

Fintech as a Service Market Revenue Analysis: Growth, Share, Value, Size, and Insights By 2033

"Comprehensive Outlook on Executive Summary Fintech as a Service Market Size and Share

- The global fintech as a service market size was valued at USD 466.26 billion in 2025 and is expected to reach USD 1542.35 billion by 2033, at a CAGR of16.13% during the forecast period

The Fintech as a Service report encompasses thorough analysis of market with respect to several factors about Fintech as a Service Market industry that range from market drivers, market restraints, market segmentation, opportunities, challenges, and market revenues to competitive analysis. The report presents the CAGR value fluctuations for the specific forecasted period, which helps decide costing and investment strategies. For a market segmentation study, a market of potential customers is divided into groups or segments based on different characteristics such as end user and geographical region. This Fintech as a Service Market report brings precise and exact market research information that drives your business in the correct direction.

Strategically analyzed facts and figures of the market and keen business insights covered in this Fintech as a Service report would be a key aspect in achieving enduring business growth. The report offers you steadfast knowledge and information of revolutionizing market landscape, what already exists in the market, future trends or what the market expects, the competitive environment, and strategies to plan to outshine the competitors. This Fintech as a Service Market research report uncovers the general market conditions, trends, inclinations, key players, opportunities, geographical analysis and many other parameters that helps drive your business into right direction.

Access expert insights and data-driven projections in our detailed Fintech as a Service Market study. Download full report:

https://www.databridgemarketresearch.com/reports/global-fintech-as-a-service-market

Fintech as a Service Industry Snapshot

Segments

- By Deployment Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Application:

- Personal Finance Management

- Insurance

- Loans and Payments

- Wealth Management

- Others

- By End-User:

- Banks

- Financial Institutions

- Others

Fintech as a service is gaining traction in the global market as it offers financial institutions and banks innovative solutions to enhance customer experience, streamline operations, and improve overall efficiency. The market is segmented based on deployment type, application, and end-user. In terms of deployment type, the market is categorized into public cloud, private cloud, and hybrid cloud solutions. These different deployment options provide flexibility and scalability to financial institutions looking to adopt fintech solutions. When it comes to application, fintech as a service is utilized for various purposes such as personal finance management, insurance, loans and payments, wealth management, and others. Each of these applications addresses specific needs within the financial sector, driving the demand for fintech services. Lastly, the end-user segment includes banks, financial institutions, and other entities that rely on fintech solutions to modernize their operations and services.

Market Players

- Ant Financial Services Group

- Fiserv, Inc.

- Yodlee

- Intellect Design Arena Limited

- Finastra

- Nelito Systems Ltd.

- Finomial

- Crealogix Holding

- Cloud Lending Solutions

- Finserv

- Symphony Software Foundation

- Finbourne Technology

- Technisys

- APIX Platform

- Apigee Corporation

- Axway

Key players in the global fintech as a service market are driving innovation and shaping the future of financial services. Companies such as Ant Financial Services Group, Fiserv, Yodlee, and Intellect Design Arena Limited are at the forefront of providing cutting-edge fintech solutions to meet the evolving needs of the industry. These market players offer a wide range of products and services, including personal finance management tools, insurance platforms, and wealth management solutions. By partnering with these leading fintech firms, banks and financial institutions can leverage advanced technologies to stay competitive in the digital era.

DDDDDThe global fintech as a service market continues to witness rapid growth and significant changes driven by technological advancements and evolving customer expectations. One of the key trends shaping the market is the increasing adoption of cloud-based solutions across various deployment types. Public cloud offerings provide cost-effective and easily scalable options for financial institutions to deploy fintech services rapidly. Private cloud solutions offer enhanced security and control over sensitive data, making them particularly attractive for institutions with strict regulatory requirements. Hybrid cloud deployments combine the benefits of both public and private clouds, allowing organizations to customize their fintech solutions to meet specific needs.

In terms of applications, the fintech as a service market is witnessing a surge in demand for personal finance management tools, driven by the growing emphasis on financial literacy and empowerment among consumers. Insurance platforms are also gaining traction as insurers seek to digitize their operations and improve customer engagement through personalized services. The loans and payments segment remains crucial as financial institutions strive to provide seamless and efficient transaction processes. Wealth management solutions are increasingly being adopted to cater to the complex needs of high-net-worth individuals and institutional investors.

The end-user segment of the fintech as a service market primarily comprises banks, financial institutions, and other players in the financial services industry. These entities are increasingly turning to fintech solutions to enhance their competitiveness, improve operational efficiency, and deliver superior customer experiences. By leveraging fintech platforms and services, banks can optimize their processes, reduce costs, and better manage risks in a rapidly changing regulatory environment. Financial institutions are also exploring partnerships with fintech providers to access innovative technologies and accelerate their digital transformation initiatives.

Key market players such as Ant Financial Services Group, Fiserv, Yodlee, and Intellect Design Arena Limited are playing a pivotal role in driving innovation and shaping the future of financial services. These companies are continuously investing in research and development to introduce cutting-edge fintech solutions that address the evolving needs of the industry. By focusing on user-centric design, data security, and regulatory compliance, these market leaders are helping to redefine the way financial services are delivered and consumed. As the fintech ecosystem continues to evolve, collaboration and partnerships between traditional financial institutions and fintech firms will be essential to driving innovation and sustaining growth in the market.The global fintech as a service market is experiencing a significant transformation driven by technological advancements and changing customer preferences. One of the key trends observed in the market is the increasing adoption of cloud-based solutions, offering financial institutions cost-effective and scalable options to deploy fintech services swiftly. The shift towards public cloud solutions enables organizations to leverage flexible resources, facilitating rapid innovation and service delivery. Private cloud deployments, on the other hand, cater to institutions requiring enhanced data security and compliance capabilities. Hybrid cloud models combine the benefits of both public and private clouds, allowing firms to customize their fintech solutions according to their specific requirements.

In terms of applications, there is a growing demand for personal finance management tools as consumers increasingly focus on financial literacy and empowerment. Insurance platforms are also gaining traction as insurers embrace digital transformation to enhance operational efficiency and deliver personalized services to customers. The loans and payments segment remains critical for financial institutions aiming to streamline transaction processes and offer seamless payment experiences. The adoption of wealth management solutions is on the rise, especially among high-net-worth individuals and institutional investors seeking tailored financial advice and portfolio management services.

Within the end-user segment, banks, financial institutions, and market players in the financial services industry are increasingly turning to fintech solutions to boost competitiveness, drive operational efficiency, and enhance customer satisfaction. By leveraging fintech platforms and services, these entities can optimize their operations, reduce costs, and mitigate risks in a dynamic regulatory landscape. Collaborations and partnerships between traditional financial institutions and fintech companies have become essential for driving innovation and sustaining growth in the market. Key players such as Ant Financial Services Group, Fiserv, Yodlee, and Intellect Design Arena Limited are leading the way in developing cutting-edge fintech solutions that cater to the evolving needs of the industry, focusing on user-centric design, data security, and regulatory compliance to redefine the delivery and consumption of financial services. As the fintech ecosystem evolves, these market leaders will continue to invest in research and development to introduce innovative solutions that reshape the future of financial services.

In conclusion, the global fintech as a service market is poised for continued growth and disruption as organizations across the financial sector embrace advanced technologies to meet the evolving demands of customers and regulatory requirements. The convergence of cloud computing, personalized financial applications, and collaborative partnerships between fintech providers and traditional institutions will drive innovation and shape the future landscape of financial services. By staying agile, customer-centric, and compliant with industry regulations, market players can capitalize on emerging opportunities and navigate the complex dynamics of the fintech ecosystem.

Discover the company’s competitive share in the industry

https://www.databridgemarketresearch.com/reports/global-fintech-as-a-service-market/companies

Market Intelligence Question Sets for Fintech as a Service Industry

- How big is the current global Fintech as a Service Market?

- What is the forecasted Fintech as a Service Market expansion through 2032?

- What core segments are covered in the report on the Fintech as a Service Market?

- Who are the strategic players in the Fintech as a Service Market?

- What countries are part of the regional analysis in the Fintech as a Service Market?

- Who are the prominent vendors in the global Fintech as a Service Market?

Browse More Reports:

Global Pharmaceutical Logistics Market

Global Polyethylene Terephthalate (PET) Resins Market

Global Pore Strips Market

Global Radiation Hardened Electronics Market Analysis and Market

Global Respiratory Rate Sensors Market

Global Sheet Metal Market

Global Smart Home Appliances Market

Global Traditional Toys and Games Market

Global Umami Flavours Market

Global Unified Communication as a Service (Ucaas) Market

Global Vital Wheat Gluten Market

Global Waffles and Wafers Market

Europe Colour Cosmetics Market

Europe Corrugated Packaging Market

Europe Data Centre Cooling Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness